Get This Report on Palau Chamber Of Commerce

Table of ContentsA Biased View of Palau Chamber Of CommerceLittle Known Questions About Palau Chamber Of Commerce.A Biased View of Palau Chamber Of CommerceIndicators on Palau Chamber Of Commerce You Need To KnowThe Greatest Guide To Palau Chamber Of CommercePalau Chamber Of Commerce - The FactsThe Best Guide To Palau Chamber Of CommerceThe Ultimate Guide To Palau Chamber Of Commerce

As a result, not-for-profit crowdfunding is getting the eyeballs these days. It can be made use of for details programs within the company or a basic contribution to the reason.Throughout this action, you could want to think about milestones that will show a possibility to scale your nonprofit. As soon as you have actually run for a little bit, it's vital to take some time to believe about concrete growth objectives.

7 Easy Facts About Palau Chamber Of Commerce Shown

Resources on Beginning a Nonprofit in numerous states in the US: Beginning a Nonprofit FAQs 1. Exactly how much does it set you back to begin a not-for-profit organization?

The smart Trick of Palau Chamber Of Commerce That Nobody is Talking About

With the 1023-EZ form, the processing time is commonly 2-3 weeks. Can you be an LLC and a nonprofit? LLC can exist as a nonprofit restricted obligation business, nevertheless, it should be completely had by a single tax-exempt nonprofit organization.

What is the difference between a foundation as well as a nonprofit? Foundations are generally moneyed by a family members or a corporate entity, but nonprofits are funded through their incomes as well as fundraising. Foundations normally take the cash they started with, invest it, and afterwards disperse the cash made from those financial investments.

Palau Chamber Of Commerce Things To Know Before You Get This

Whereas, the additional cash a not-for-profit makes are used as running costs to money the company's mission. Is it tough to begin a nonprofit company?

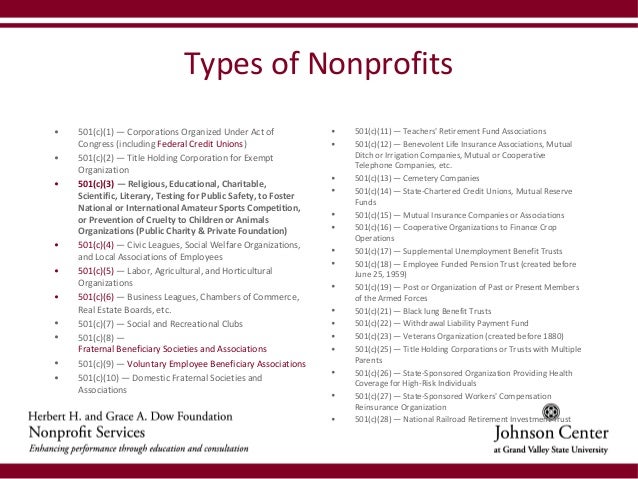

There are a number of actions to start a nonprofit, the barriers to entrance are relatively couple of. 7. Do nonprofits pay tax obligations? Nonprofits are excluded from federal earnings taxes under section 501(C) of the internal revenue service. However, there are specific scenarios where they might require to pay. As an example, if your nonprofit makes any type of income from unrelated tasks, it will owe earnings tax obligations on straight from the source that particular amount.

The Main Principles Of Palau Chamber Of Commerce

By much the most usual type of nonprofits are Area 501(c)( 3) organizations; (Area 501(c)( 3) is the part of the tax obligation code that authorizes such nonprofits). These are nonprofits whose mission is philanthropic, religious, academic, or scientific.

Excitement About Palau Chamber Of Commerce

The bottom line is that private foundations get much even worse tax obligation therapy than public charities. The main difference in between exclusive structures and also public charities is where they obtain their financial backing. A personal foundation is usually managed by a private, household, or corporation, and gets the majority of its earnings from a few contributors and investments-- a fine example is the Expense as well as Melinda Gates Structure.

The Only Guide for Palau Chamber Of Commerce

This is why the tax obligation legislation is so hard on them. A lot of foundations just give cash to other nonprofits. Somecalled "running foundations"operate their very own programs. As a sensible matter, you require at the very least $1 million to begin an exclusive structure; or else, it's not worth the trouble as well as cost. It's not unexpected, after that, that a private structure has actually been explained as a large body of money surrounded by people that want a few of it.

Various other nonprofits are not so fortunate. The IRS originally assumes that they are private structures. However, a new 501(c)( 3) company will certainly be identified as a public charity (not an exclusive foundation) when it obtains tax-exempt standing if it can reveal that it sensibly can be expected to be publicly supported.

The Only Guide to Palau Chamber Of Commerce

If the IRS categorizes the not-for-profit as a public charity, it maintains this standing for its very first five years, despite the public assistance it really receives throughout this time. Palau Chamber of Commerce. Starting with the not-for-profit's sixth tax advice obligation year, it must show that it satisfies the general public support test, which is based upon the support it obtains throughout the current year and also previous four years.

If a not-for-profit passes the test, the internal revenue service will proceed to monitor its public charity status after the initial five years by needing that a finished Arrange A be filed yearly. Palau Chamber of Commerce. Discover more concerning your nonprofit's tax standing with Nolo's book, Every Nonprofit's Tax obligation Guide.